Transaction processing fees: They add up, and they can eat into your profit margin.

If you want to keep more money in your business, you have some options. I’ll lay them out here.

First, some data.

Real Numbers From Real Gyms

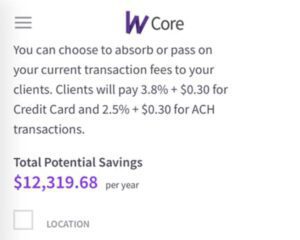

Wodify has a reporting tool that can help a gym owner determine whether to absorb or pass on processing fees.

In our private Facebook group for clients, we asked gym owners to run that report or post their numbers. This is real data from Two-Brain gyms:

- One gym owner showed us a screenshot from the Wodify report: The potential savings are $12,320 a year.

- On $328,000 of processing, one owner absorbs $9,300—but she adjusts her membership prices accordingly so she doesn’t give away her profit.

- One gym owner who adds a 2 percent credit-card surcharge said the fee generates more than $10,000 every year.

- Another gym owner passes on $900 in processing fees per quarter.

- One gym owner runs about $15,000 in transactions per month and saves $400 each month.

These numbers are significant, so it’s worth considering your options.

1. Price Fees Into Membership

This plan works only if you set your prices properly—and many gym owners do not.

For example, if you just copy the monthly rate from the gym down the street, you’ll likely copy the errors of that gym owner, who probably didn’t consider value and profit margins.

Your rate should reflect your true value and ensure you generate a profit. We want to protect a 33 percent profit margin in gyms, and you must balance profit against fixed costs and the costs of delivering the service.

Many gym owners don’t do this. Or they consider staffing and fixed costs such as rent but leave processing fees out of the equation.

If you choose to include processing fees in your membership price, ensure your prices cover all expenses and generate the profit you need. And if processing rates change, make sure you’re prepared to adjust your rates, too (a mentor can help).

2. Switch to ACH

Automated clearing house (ACH) transfers cost less than credit-card transactions.

From Hubspot.com: “ACH payments typically charge a fee between 0.5 to 1.5 percent, far lower than credit cards’ fee that ranges from 1.5 to 3.5 percent.”

The downside of ACH transfers? They generally take longer. Most online resources recommend you budget one to three business days for the processing of ACH transfers. And if a payment is declined, you might not find out right away.

Delays aren’t a problem if you watch your cash flow and plan for the lag. Delays are a huge problem if you’re relying on a Jan. 31 payment so you can make Feb. 1 rent.

If you go this route, make sure you have the cash reserves you need to cover payroll and other expenses.

3. Pass Processing Fees on to Clients

You can choose to add a transaction fee to payments to cover your costs—or offer a reduced rate for those paying with other methods.

If you’re using Wodify, the company is working on an option to have transaction costs show up on a member’s statement as a “service fee,” much as Ticketmaster does. The benefit of this presentation is that the client understands this fee was not added by the gym and isn’t related to the services being provided. The service price remains the same.

Wodify CEO Brendan Rice told me he’s seen very little pushback from clients in gyms that have used a simple setting adjustment to add a transaction fee in the Wodify system.

“We have, I think, around a thousand gyms using it now. And the feedback has been overwhelmingly positive—and overwhelmingly positive in terms of client feedback and reception when gyms do roll it out,” he said. (You can listen the whole interview here.)

Before you choose this path, quickly research your local laws.

For example, as of December 2023, Connecticut, Maine and Massachusetts did not allow surcharging. There’s a limit to what you can add as a surcharge, and you will find regional variations. For example, Colorado limits surcharging to 2 percent.

Other countries and jurisdictions will have their own policies. Make sure you stay onside of all laws.

Resource: “Credit Card Surcharge Laws by State Explained”

Wodify has templates to help you roll out a change like this. The language is along these lines: “This change will benefit you because we’re going to reinvest in the gym. This is why we’re doing it. On your next invoice, there will be a service fee for credit transactions.”

Here’a s bonus chunk of text you might adjust for your business: “We are making changes to our billing process to provide new options: Starting [DATE], memberships paid by credit card will include a [X] percent processing fee. To minimize the fee, you can switch to ACH billing.”

Pick Your Path

The worst plan of all is this: Just running your transactions without realizing you’re giving up a percentage to a processor.

At the very least, review your processing fees today so you have a better idea of how much money you’re actually getting when you run that $250 transaction. And stay on top of this because a small change in processing fees can take a chunk out of your cash flow.

A great gym owner will research all the options and pick one of the paths laid out above.

If you ensure your business handles processing fees properly, you can significantly improve the number on your bottom line without raising rates or acquiring new clients.