If you try to deadlift a 400-lb. barbell, there’s a good chance you’re going to struggle.

But if you try to move the same weight with a deadlift jack, you could do it easily with one hand. The long lever arm of the deadlift jack lets you move a large load with little effort. That’s leverage.

So what does this have to do with buying a gym?

In business, debt is form of financial leverage: It helps you do things you wouldn’t be able to do otherwise.

All of the world’s wealthiest people used financial leverage to get rich. But leverage is a double-edged sword, and if you make a bad decision, it can be ruinous.

That’s why it’s important to understand how to use debt.

Expand Your Gym Empire

Gym owners most commonly use debt to buy or build a second gym, and there are pros and cons to each approach.

My preference is buying a profitable gym that isn’t reliant on the current owner. This gives you the greatest chance of success.

At Two-Brain, we’ve talked to hundreds of gym owners who’ve destroyed their net worth by going from one to two locations. The story is always the same:

1. The gym owner has one successful location.

2. They start a second location.

3. The second location struggles.

4. The gym owner spends time, attention and money at the second location at the expense of the successful first location.

5. Eventually, the gym owner has two struggling locations.

6. They call Two-Brain Business for help.

Unfortunately, by the time we talk with them the damage has usually been done.

If you have a successful gym, it’s important to mitigate risk when you expand.

I believe the best way to do that is by buying a gym that’s already successful. The problem: Buying a successful gym requires a lot of capital. That’s where debt comes in.

Below you’ll find the six tried-and true ways to use debt to buy a gym.

1. SBA Loan

If you’re in the U.S., an SBA loan is the easiest way to buy an existing gym business.

The SBA, or Small Business Administration, is a government agency that helps small businesses access capital to start or expand operations. The SBA guarantees loans, so banks are more likely to lend to you because a large chunk of the loan is backed by Uncle Sam.

The most common loan type is a 7(a) loan. This program allows you to buy a profitable business that has been operating for at least two years.

The typical loan term is 10 years, and the interest rates are currently in the range of 8.75-11 percent. To qualify, you need a 690 credit score, industry experience and at least a 10 percent down payment.

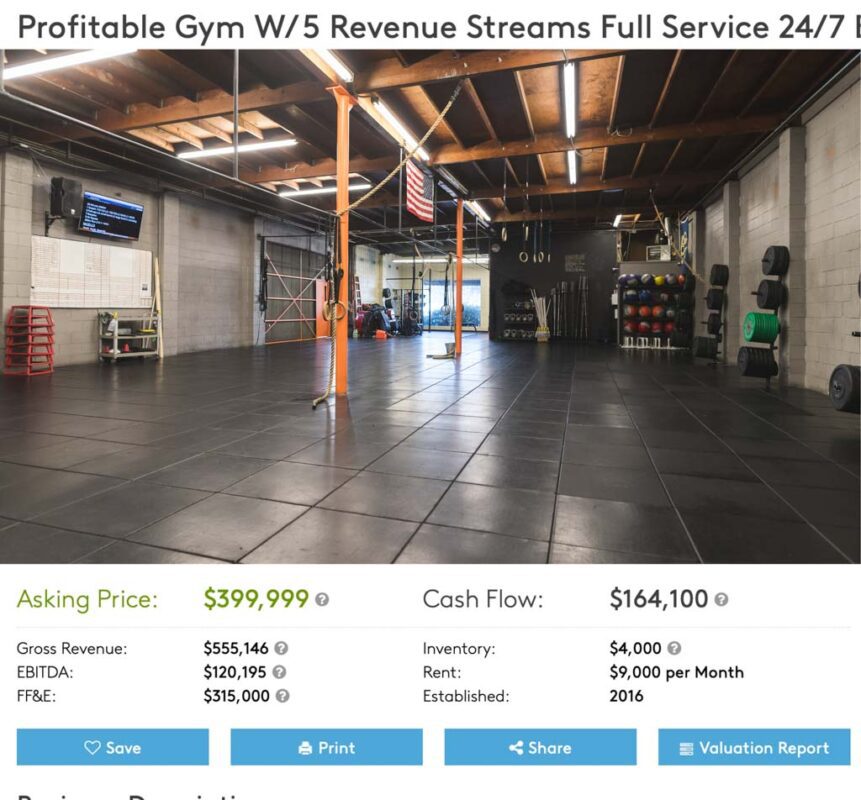

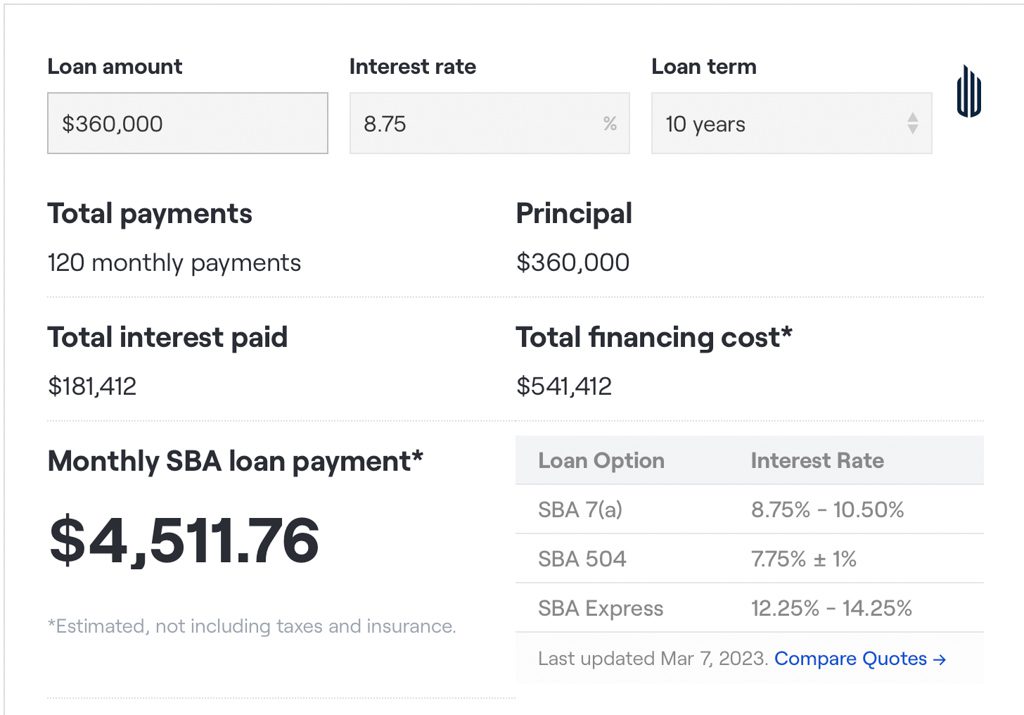

So let’s say you wanted to buy this gym for $400,000:

With a 7(a) loan:

- You’ll need to put down $40,000, and the SBA will cover the other $360,000.

- At a rate of 8.75 percent, the payment on that loan would be around $4,500 a month.

- If the business has current cash flowing of $13,600 a month, that leaves $9,100 at the end of every month for you—assuming the initial owner is removed from the gym and the business continues to perform at the same level under your ownership.

Buying an SBA-prequalified business is a great way to buy an existing gym because of the low down payment, looser qualification requirements and buyer-friendly loan terms. This is also the loan type I recommend when GMs or personal trainers want to buy out the owner of the gym they work at.

2. Owner Financing

This is when the current owner finances some or all of a business acquisition.

I always look for some form of owner financing when I buy a business. It is a clear indicator that the owner believes in the future prospects of the business and is willing to put their money where their mouth is.

For most SBA deals, an owner will likely need to finance 5-10 percent of the purchase price. For smaller or unprofitable businesses, the owner can finance as much as 100 percent of the purchase price. This deal structure is more common when the buyer and seller have an existing relationship.

Owner financing can be structured as a traditional loan with a payment term and a set interest rate. Or the owner can be paid a percentage of revenue for a period of time or until a set dollar amount is reached.

I’ve done deals where the owner has financed 100 percent of the purchase price, and as a buyer, I think they’re fantastic.

3. Friends and Family Money

Most gym owners access capital by borrowing money from friends and family.

The good part: Friends and family will usually give you much better terms than any lender. The bad part: If you don’t succeed, you risk damaging relationships with people who matter to you.

My advice to those taking this approach is to first create a document that lays out the terms of the loan before you go out to pitch.

Here are two different structures for the loan:

1. Term loan. Example: You borrow $100,000 at 10 percent for 10 years and pay back $1,321 every month.

2. Lump sum repayment. Example: You borrow $100,000 at 10 percent for 10 years, but you don’t make monthly payments. Instead, you repay the loan, plus interest, at the end of the term. In this example, you’d owe $259,000 at the end of the 10-year period. This is an ideal set-up if the business you’re buying is unprofitable because it lets you preserve cash when you’re starting out.

I’ve included sample term-loan and lump-sum-repayment agreements at the end of this post.

4. Collateralized Line of Credit

This is borrowing money against other assets you have, like stocks or home equity. The strategy only works if you have assets far in excess of your liabilities.

The interest rate on a collateralized line of credit can be as low as 1-3 percent, the repayments are flexible, and there are no origination or closing fees. That’s why rich people love using credit lines to buy stuff.

Often when a home is purchased “all cash,” it is actually purchased using a line of credit so the buyer doesn’t have to sell the underlying assets and suffer the tax implications.

Banks will typically lend you 50-70 percent of the value of your assets. The danger of this approach is that you can get a “margin call” if the value of the underlying assets decreases, which can force the sale of your assets at a bad time.

5. Credit Cards or Similar Lenders

Only use this path as a last resort.

Interest rates on most credit cards and predatory lending products are 20 percent or higher.

This is one of the worst ways to start a business or fund a business acquisition. But many successful entrepreneurs got their start by doing this, so I’m wary of saying “never do it.”

6. Equity

If you have an existing business or are buying a new business, you can raise money by selling equity.

If your gym is successful, this is the most expensive money you’ll ever borrow.

When starting out, avoid selling equity because you’ll likely need to give up a large piece of your business to raise a meaningful amount of cash. You can always bring on a strategic partner later when your business is more valuable.

Which Option Is Right for You?

Debt can be a powerful tool for growing your gym if used wisely, but one bad loan can ruin everything you’ve worked hard to build.

Ultimately, the decision to use debt is personal, as is the decision about the type of debt that’s best for your situation. By understanding the different ways to use debt to your advantage, you can make informed decisions and take calculated risks.

The decision to buy a gym or expand to a second location shouldn’t be taken lightly. Before taking the plunge, it’s best to consult with a mentor who has run multiple facilities. If you want to learn more about how a Two-Brain mentor can guide you through the process, book a call with our team.

Sample Agreements

Below, you’ll find two examples of a simple loan agreement a gym owner could use to borrow money from a family member.

As with any important document, it should be tailored to your business. Consult a lawyer or other professional.

Sample Term Loan Agreement

Loan Agreement

This Loan Agreement (“Agreement”) is made and entered into on [date] by and between [name of borrower], with an address at [address], (“Borrower”), and [name of lender], with an address at [address], (“Lender”).

Loan Amount

Borrower promises to pay to Lender the sum of [loan amount] dollars ($[loan amount]), which shall be used for the purpose of [purpose of loan], on or before [date of repayment].

Interest Rate

The loan shall accrue interest at a rate of [interest rate] percent per annum, which shall be calculated on the outstanding balance of the loan.

Repayment

Borrower shall make payments to Lender in the amount of [payment amount] dollars ($[payment amount]) on a [weekly/monthly/other] basis, beginning on [date of first payment] and continuing until the loan is repaid in full.

Collateral

Borrower shall provide [description of collateral], which shall serve as collateral for the loan.

Default

Borrower shall be in default under this Agreement if Borrower fails to make any payment when due or breaches any other term or condition of this Agreement. Upon default, Lender may declare the entire unpaid balance of the loan, together with all accrued interest, immediately due and payable.

Governing Law

This Agreement shall be governed and construed in accordance with the laws of [state/country].

Entire Agreement

This Agreement constitutes the entire agreement between the parties and supersedes all prior negotiations, understandings, and agreements between them.

Execution

This Agreement may be executed in counterparts and may be signed electronically or by facsimile. Each counterpart shall be deemed an original, and all counterparts together shall constitute one and the same instrument.

Borrower: [signature]

Lender: [signature]

Sample Lump Sum Repayment Loan Agreement

Loan Agreement

This Loan Agreement (“Agreement”) is made and entered into on [date] by and between [name of borrower], with an address at [address], (“Borrower”), and [name of lender], with an address at [address], (“Lender”).

Loan Amount

Borrower promises to pay to Lender the sum of [loan amount] dollars ($[loan amount]), which shall be used for the purpose of [purpose of loan], on or before [date of repayment].

Interest Rate

The loan shall accrue interest at a rate of [interest rate] percent per annum, which shall be calculated on the outstanding balance of the loan.

Repayment

Borrower shall repay the loan, plus interest, in full at the end of the term. In this example, the loan amount is $[loan amount], and the term is [term length] years. The total amount owed at the end of the term is $[total amount owed], which includes the original loan amount plus interest.

Collateral

Borrower shall provide [description of collateral], which shall serve as collateral for the loan.

Default

Borrower shall be in default under this Agreement if Borrower fails to repay the loan, plus interest, in full at the end of the term. Upon default, Lender may declare the entire unpaid balance of the loan, together with all accrued interest, immediately due and payable.

Governing Law

This Agreement shall be governed and construed in accordance with the laws of [state/country].

Entire Agreement

This Agreement constitutes the entire agreement between the parties and supersedes all prior negotiations, understandings, and agreements between them.

Execution

This Agreement may be executed in counterparts and may be signed electronically or by facsimile. Each counterpart shall be deemed an original, and all counterparts together shall constitute one and the same instrument.

Borrower: [signature]

Lender: [signature]

About the Author: John Franklin is Two-Brain’s chief marketing officer and the co-founder of Kilo.

Other Media in This Series

“How to Get Cash Fast (Without Destroying Your Business)”

“5 Ways to Make Money Fast Without Hurting Your Gym”