Inflation is still a thing, even if it’s not as bad as it was a year ago.

The easiest way to cover inflation and preserve or increase your profit margin is to increase the revenue you earn per client.

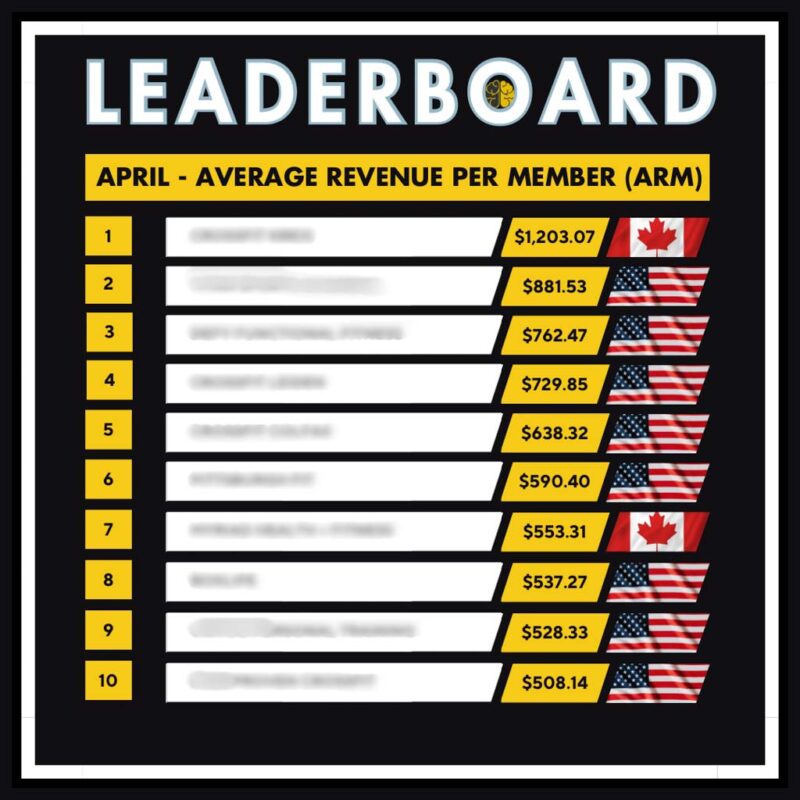

In the first post in this series, I shared our leaderboard for average revenue per member—ARM—for April 2024. Here it is again:

Today, I’m going to give you three battle-tested ways to earn more from your clients.

1. Implement an Annual Rate Increase

Simply add an annual 3 percent rate increase for all incoming members. Let them know when they sign up that rates increase 3 percent at the beginning of each year.

You can follow this plan with existing members, but most gyms need to make a larger jump right away because of very low prices, so 3 percent a year won’t cut it.

If your average ARM is below $180, get it there first, then move to annual increases. (I strongly recommend you navigate a rate increase with the help of a mentor.)

2. Switch to Biweekly Payments

Example: Instead of charging $200 per month, charge $100 biweekly. Your clients won’t really feel a difference.

If one of our gyms that charges $500 a month did this, it would collect an extra $500 from the client over the course of the year (12 x $500 is $6,000, while 26 x $250 is $6,500).

In some cases, biweekly billing matches up better with clients’ paydays, making it easier for them to budget.

3. Credit Cards: Move on or Pass On

Credit-card transactions are convenient but really a win for the processor: You’re giving a percentage away.

You have two options: Switch to ACH (automated clearing house) transfers or pass credit-card fees on to clients.

ACH: These transfers cost less than credit-card transactions. From Hubspot.com: “ACH payments typically charge a fee between 0.5 to 1.5 percent, far lower than credit cards’ fee that ranges from 1.5 to 3.5 percent.”

The downside of ACH transfers? They generally take longer. Most online resources recommend you budget one to three business days for the processing of ACH transfers. And if a payment is declined, you might not find out right away.

Delays aren’t a problem if you watch your cash flow and plan for the lag. Delays are a huge problem if you’re relying on a Jan. 31 payment so you can make Feb. 1 rent. If you go this route, make sure you have the cash reserves you need to cover payroll and other expenses.

Pass on Fees: Before you choose this path, quickly research your local laws. A few U.S. states don’t allow surcharging, and there are regional variations on surcharge limits.

Other countries and jurisdictions will have their own policies. Make sure you stay onside of all laws.

Resource: “Credit Card Surcharge Laws by State Explained”

Here’s a chunk of text you might adjust for your business: “We are making changes to our billing process to provide new options: Starting [DATE], memberships paid by credit card will include a [X] percent processing fee. To minimize the fee, you can switch to ACH billing.”

If you don’t eat the cost of processing cards, that will boost your revenue by a few thousand dollars every year. Sample math: If you process $100,000 in credit-card transactions every year and give away 2.5 percent, that’s $2,500.

ARM: Your First Target

If your P&L statement is in rough shape, these options might not fix the problem. In that case, I recommend you work with a mentor to roll out a larger increase that will stabilize your gym.

But if your rates are in the right range and you’re looking for ways to boost ARM without a price change, these three options can move the needle.

Remember, your first targets are 150 clients and $205 ARM—but the leaderboard above shows that the right clients are willing to pay much more for incredible service. A mentor can help with that, too.